MATHEMATICS, FINANCE & FINANCIAL PLANNING

What Are Your Goals?

Perhaps you want a nice home?

Do You Have Experiential Goals?

Perhaps you want quality family time with your spouse and children?

Do You Have Achievement Goals?

Perhaps you have goals for your children to attend a prestigious university? Or for yourself to get an advanced degree?

Austin doesn't judge or tell people what they should want.

He simply wants to help you become your best self.

Perhaps you have unique and special gifts that you can use

to make this world a better place?

Whatever goals you have Austin is here to help you achieve them faster.

Mathematical Platform to Optimize Your Goal Achievement

Whatever your goals are, there are usually some financial aspects to them.

"You work hard for your money; your money should work hard for you."

This is why Austin wrote a mathematical platform to integrate all areas of finance, law and real estate, etc. to find a balanced, optimized financial solution set around your unique goals and challenges.

However, math being as it is, you may need to start with a little inspirational story...

Austin's Inspirational Math Story

Austin's mother taught him when he was young, "Use whatever God-given talents you have to make this world a better place." To a younger Austin, this was not just some nice idea, but an imperative to find love and happiness.

As it turns out, there were many things Austin was not good at and he got depressed feeling like he would never find love and happiness. Well, Austin always knew from the time he was little that he was gifted in math, but it seemed no one cared, especially girls! Perhaps his nerdy math teachers cared, but when he was young, he still didn't know how to use math to make a significant positive difference in people's lives and thus help make the world a better place.

Austin's depressing situation finally turned around in college when he studied finance and financial planning and discovered his special talents really could make a dramatic positive difference in people's lives! Not only that, but Austin did find a beautiful girl that actually liked nerds. Wow! They fell deep in love, got married, and are now raising their 4 amazing children!

Below, you'll see how Austin cares about people and uses math and financial training to coach, uplift and transform their financial and emotional lives to the ultimate goal of self-actualization or being one's best.

AUSTIN'S TRANSFORMATIONAL MATH & FINANCIal planning JOURNEY

An Expression of Passion

When Austin found financial planning as his vehicle for focusing his talent, passion, and caring for people, he dove deep into its study taking practically every class he could find and reading many hundreds of books of the subject. He took State and Federal exams to get licensed. He attended countless seminars, boot camps, training classes and got private mentoring to learn how to make the greatest positive difference in people's lives. After becoming well-studied, Austin went on to serve many hundreds of clients.

Sometimes People Need a Little Help

Austin learned the stark realities of people's lives. It took a deep passion and commitment to help people through some very difficult situations.

Naturally at first, when Austin initially studied financial planning, it was all about the different financial products on the market and in what situations does one product or strategy work better than another.

But sometimes it goes deeper, and people really need a transformation.

Break Through Emotional Barriers

Transformational Financial Planning is using strategies and techniques to help people break through emotional barriers to dramatically improve their financial outlook. This involves a deeper dive into goal planning to understand internal motivations.

People are commonly conflicted with counteracting goals

that lead to subconscious fears and self-sabotage.

Effective Strategy

While motivation is absolutely critical, so is implementing the right strategy.

Austin has met so many people who could whip themselves into an emotional frenzy, but despite being highly motivated to take massive action,

they are still not getting ahead.

This is because they don't have the right strategy.

Pushing twice as hard against a brick wall to get to the other side, just means you get burnt out faster. You may need to find another way:

there is always a doorway to the other side; you just need to find the key.

Everyone's Key Is Unique

Firstly, Your Optimal Prosperity Plan is customized specifically to your

goals, plans and passions — it is YOUR plan.

Secondly, the right strategies only come out through working the process.

Thirdly, the speed comes from the mathematical optimization.

Use Austin's experience to help you find YOUR key.

An Example in Debt to Wealth — Finding Their Key

Austin served an actual couple that had excessive debts, but wanted to be able to retire debt-free soon with enough financial assets to last for the rest of their lives.

Finding Their Key

FIRSTLY GOALS: In this sample case, the couple started with a clear goal.

Most people have many conflicting goals.

SECONDLY STRATEGIES: Precisely how to achieve this rapid financial transformation is far more complex. This is where Austin's many years of experience helped in working through a process to develop the effective strategies specific to their unique situation, capacities and goals.

THIRDLY MATHEMATICAL OPTIMIZATION: With his platform, Austin found many mathematical accelerators to optimize the speed of their transformation

from debt to wealth. Austin can teach you how to do the same!

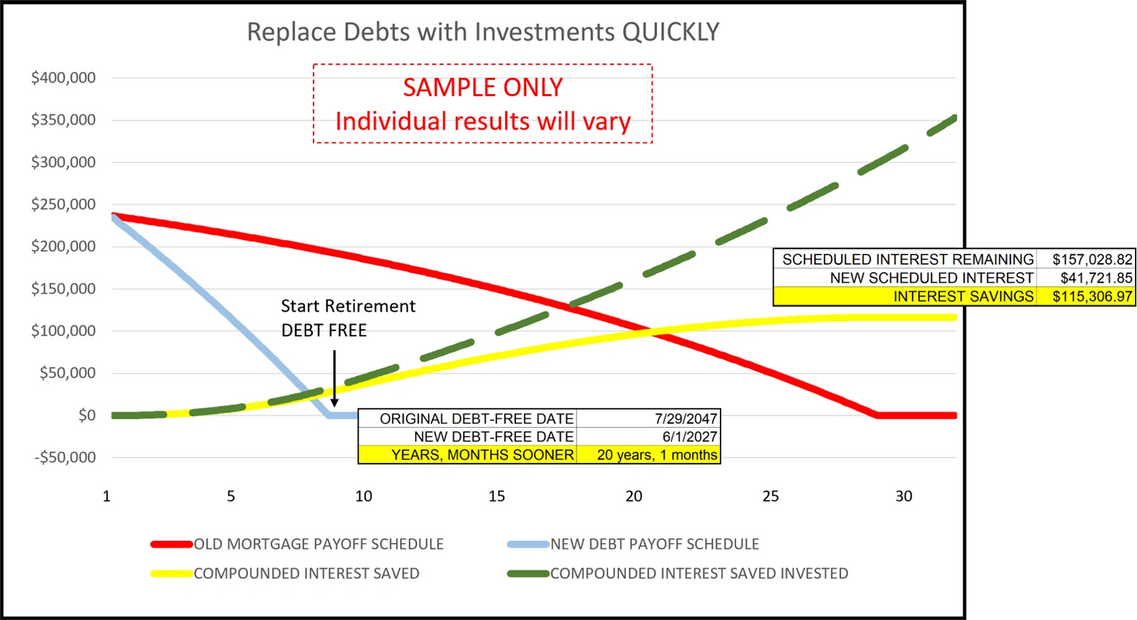

See the dramatic result in the actual client sample below:

MATHEMATICAL OPTIMIZATION EXAMPLE

A Rapid Financial Transformation

The red line shows 27 more years for this couple to finish paying off their home mortgage. Their challenge is that they expect to retire in 7 and 1/2 years. Their concern was having to make mortgage payments out of their retirement income. With Austin's utilization of many accelerators and mathematical optimization, he was able to cut their payoff time by 20 years and 1 month. They should be able to retire on schedule debt-free and with sufficient risk-mitigated assets.

The key to this rapid acceleration is structuring their finances in such a way as to cut out the bulk of interest. As you can see, their interest saved was over $115,300 as shown by the yellow line. If this couple were to redirect their interest savings into an investment account throughout this process, as shown by the green dashed line, they could build up hundreds of thousands of dollars over the next 27 years — when they otherwise would have just finally paid off their old mortgage!

For free, you can learn how using advanced math can make the difference between retiring wealthy or sliding into poverty during retirement.

For free, you can watch Austin’s YouTubes and do this highly valuable analysis yourself. Austin can teach you how.

Austin Guarantees:

1) You will have more peace of mind knowing you are implementing your own plan with greater precision.

2) You will find this goal planning and optimization process will teach you vital skills that you can use for the rest of your life.

SEE THE BIG PICTURE

Listen to Austin, talk about his debt to wealth journey and discover critical insights that will help you advance rapidly and become your best self!

Privacy Policy

Austin Greiner Sr. will not share your private information with anyone without your consent. Period.